Equity mutual funds invest at least 60 of their assets in equity shares of numerous companies in suitable proportions. More debt leads to more risks but increases profitability due to less cost.

Return On Equity Interpretation Meaning Investinganswers

Return On Equity Roe Formula Definition And More Stock Analysis

Return On Equity Roe Formula And Definition Macrotrends

In its most general meaning this term includes every case in which real or personal property is charged with the.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

Return on equity meaning. It is the employees that will determine what an equitable return should be. Return on equity ROE is a financial ratio that shows how well a company is managing the capital that shareholders have invested in it. Return on Assets ROA.

You get a lump sum todayup to 350kin return for a share in the future appreciation of your home. Equity mutual funds invest in the shares of different companies. Return ratios represent the companys ability to generate returns to its shareholders.

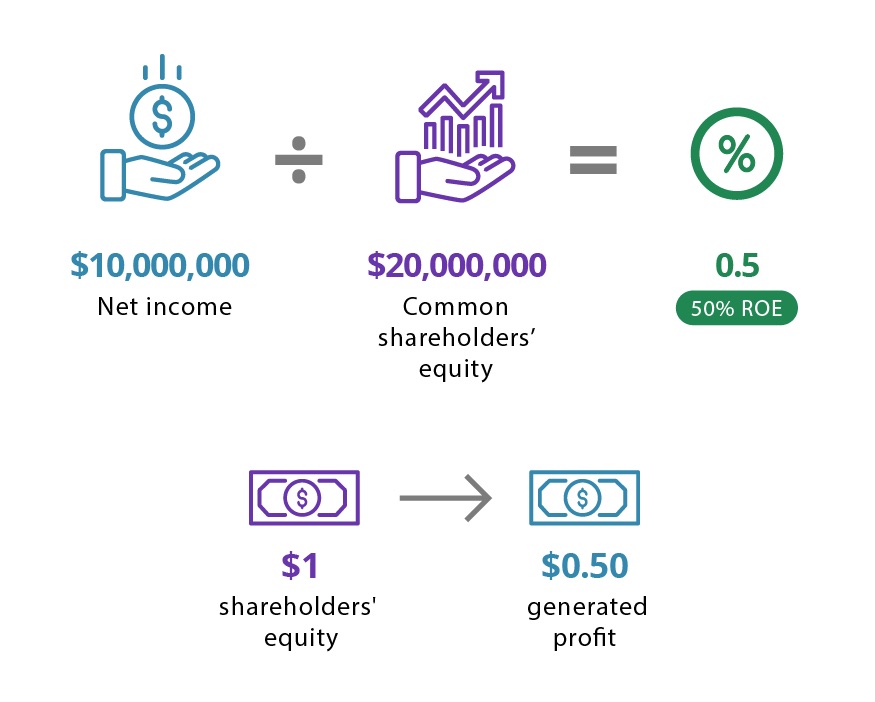

We calculate it by dividing the net income of the firm in question by shareholders equity. An investor buys 1000 worth of stocks and sells them 1 year later when their value reaches 1500. Meaning of equity.

The relationship between two groups or amounts that expresses how much bigger one is than the. Return on Net Worth RONW is a measure of the profitability of a company expressed in percentage. This results in higher profit margins.

Measures how much profit a company generates for every 1 of company equity held by shareholders. A proper mix of equity and debt should be maintained so that there are a sound and fair composition of capital. Equity has two main elements inputs and outputs or outcomes.

A companys return on equity can be used to predict its growth rate also known as the sustainable growth rate. Learn more about the different types their benefits return taxation of equity funds. This required costly monthly payments tying up your capital for years.

The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdingsReturn on equity signifies how good the company is in generating returns on the investment it received from its shareholders. As a legal system it is a body of law that addresses concerns that fall outside the jurisdiction of Common LawEquity is also used to describe the money value of property in excess of claims liens or mortgages on the property. How Brand Equity Impacts Return on Investment ROI Brand equity can positively affect the bottom line in the following ways.

ROCE is different from Return on Equity ROE Return on Equity ROE Return on Equity ROE is a measure of a companys profitability that takes a companys annual return net income divided by the value of its total shareholders equity ie. A trader enters such a neutral combination of trades. Founded in 1975 TASH advocates for human rights and inclusion for people with significant disabilities and support needs those most vulnerable to segregation abuse neglect and institutionalization.

Return on equity in real estate is a measure of the percentage return on a real estate property divided by the total equity. The net income used is for the past 12 months. A lien is the right to retain the lawful possession of another persons piece of property until the owner fulfills a legal duty to the person holding the property such as the payment of lawful charges for work done on the propertyA mortgage is a common lien.

Examples include return on assets return on equity cash return on assets return on debt return on retained earnings return on revenue risk-adjusted return. He is an expert in trading and technical analysis with more than. Meaning of capital structure.

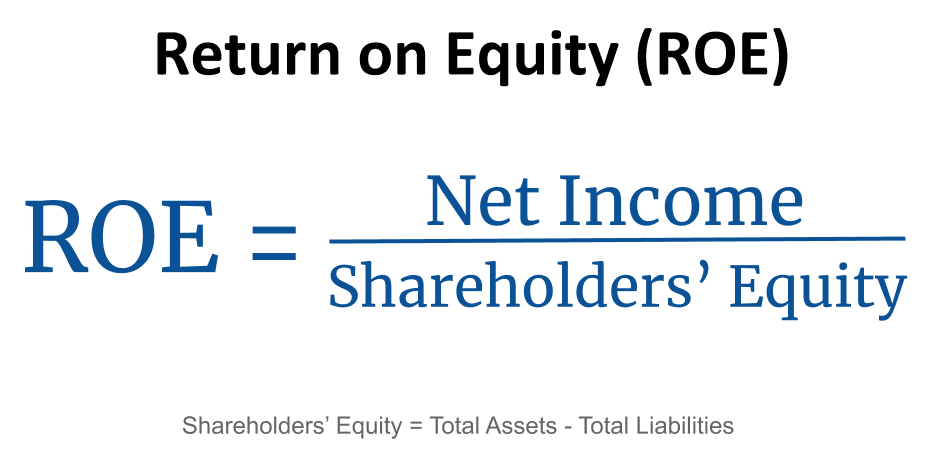

TASH is an international leader in disability advocacy. In its broadest sense equity is fairness. To calculate ROE one would divide net income by.

Return on Investment Example 1. SGR is the realistic pace at which a business can grow with internally-generated net income or profit without having to finance its growth with borrowed money or by seeking more equity from shareholders. Borrowers generally must have at least 20 percent equity in their homes to be eligible for a cash-out refinance or loan meaning a maximum of 80 percent loan-to-value LTV ratio of the homes.

TASH works to advance inclusive communities through advocacy. Explain the Concept of Capital Structure. Alan Farley is a writer and contributor for TheStreet and the editor of Hard Right Edge one of the first stock trading websites.

A 15 ROE indicates that the corporation earns 15 on every 100 of its share. The asset allocation will be in line with the investment objective. ROE is calculated as Net Income divided by Shareholders Equity and is presented as a percentage.

The meaning of equity is fairness or justice in the way people are treated. How to use equity in a sentence. To use a straddle a trader buyssells a Call option and a Put option simultaneously for the same underlying asset at a certain point of time provided both options have the same expiry date and same strike price.

The value of a company divided into many equal parts owned by the shareholders or one of the. Until now the only way to access the equity in your home was by taking on debt. Order Value per Customer.

See more meanings of equity. Capital structure is the mix of owners funds Equity and borrowed funds Debt. Return on Equity vs.

Return on Equity Meaning. Return on equity takes into account the total gain cash flow appreciation etc as a percentage of the total equity net amount of cash received if property were sold. Return on Net Worth Formula.

If your brand has positive brand equity people are more likely to spend more money to purchase those products. A straddle is a trading strategy that involves options. The Return on Common Equity ROCE ratio refers to the return that common equity investors receive on their investment.

This is after making a viable comparison between their input and outcomes with those of the other employees or colleagues. Read more demand over a risk-free rate. Risk Premium Market Rate of Return Risk-Free Rate It measures the return that equity investors Equity Investors An equity investor is that person or entity who contributes a certain sum to public or private companies for a specific period to obtain financial gains in the form of capital appreciation dividend payouts stock value appraisal etc.

Mathematically Return on Equity Net Income or ProfitsShareholders Equity. Measures a companys profit for every 1 of assets it owns. What Is a Lien.

The asset allocation can be made purely in stocks of large-cap mid-cap or small-cap companies depending on the market conditions. Return on Equity is a profitability metric that is used to compare the profits earned by a business to the value of its shareholders equity. Return on Equity ROE.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

Debt To Equity D E Ratio Definition

Return On Assets Roa Double Entry Bookkeeping

5 Ways To Improve Return On Equity The Motley Fool

7 Points Comparison On Roe Vs Roce Yadnya Investment Academy

What Is Brand Value And Brand Equity And Why They Matter Fourweekmba

-Step-10.jpg)

How To Calculate Return On Equity Roe 10 Steps With Pictures

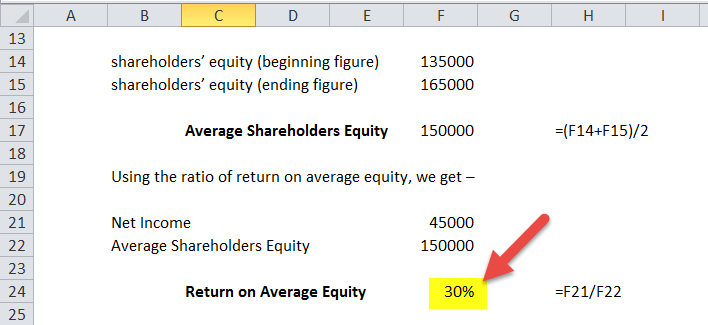

Return On Average Equity Meaning Formula How To Calculate

Return On Equity Plan Projections